Why do we invest in small cap?

Our motto Small is Powerful was not born by chance:

It is the result of a thorough study of the literature and thirty years of consistency.

When William Higgons developed his investment strategy in the early 1990s, he chose to focus on listed small and medium-sized companies.

“The father of modern portfolio theory (Eugene F. Fama) questioned the usefulness of beta and emphasised the outperformance of small stocks.”

W. Higgons

Focusing on a well-performing asset class

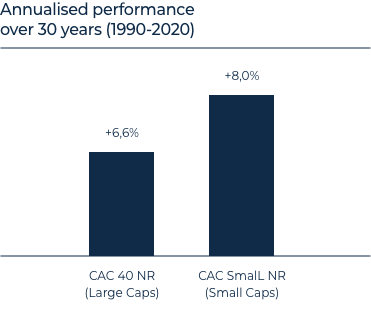

At the time, financial literature showed that this asset class (small cap) outperformed large companies (large cap).

Read

“The Cross-Section of Expected Stock Returns”

Journal of Finance, Fama and French (1992).

Several characteristics of listed SMEs explain this superior performance over a long period:

– Higher growth and investment levels than larger companies, as a proportion of their turnover

– Greater agility and adaptability, resulting from quick decision-making in shorter structures

– A better alignment of interests between the managers of these companies, often family-owned, and their shareholders

– Strong specialisation, often in unsaturated niche markets

– A less arbitrated market segment, with more inefficiencies to exploit.

Since 1992, turnover growth and stock market performance data have confirmed this analysis:

The origins of the Quality Value methodology

In 1992, William Higgons, financial analyst at the time, was searching for an efficient investment strategy. He stumbled upon a short popular article which confirmed what his readings of academic financial literature were already suggesting : so-called « Value » investment strategies are outperforming the market.

“Value investing – buying shares that look cheap compared with their fundamentals-is the oldest stock picking strategy. And still one of the best.”

“Value investing (buying shares that look cheap compared with their fundamentals) is the oldest stock picking strategy. And still one of the best.”

The Economist, “Cheap and cheerful”

Read

“Cheap and cheerful”

This article is based on a paper by Josef Lakonishok, Andrei Shleifer, Robert Vishny, “Contrarian Investment, extrapolation, and risk”, which challenges the theory of market efficiency.

Read

“Contrarian Investment, Extrapolation and Risk”

Josef Lakonishok, Andrei Shleifer et Robert W. Vishny, 1994.

In his landmark article, Josef Lakonishok has again validated the outperformance of Value strategies. More importantly, he provided tangible evidence that this outperformance is due to exploiting the behavioural inefficiency of the average investor and not to superior risk taking.

Read

“Security Analysis”

Benjamin Graham et David Dodd, 1934

Graham et Dodd, the founding fathers of value investing, show that buying stocks at low prices, relative to their earnings, dividends or net assets, produces better returns than other approaches.

Read

“What works

on Wall Street”

James O’Shaughnessy, 1997

A statistical work by James O’Shaughnessy confirms the relevance of their approach. It allows William Higgons to refine his management method by choosing the best performing financial criteria according to statistics.

To measure the quality of a company, William Higgons will use the concept of return on capital employed (ROCE), selecting the companies with the highest ROCEs in the market.

Read

“The Quality Dimension of Value Investing”

Robert Novy-Marx

“This study by Novy-Marx demonstrated the importance of ROCE in value management. ROCE was already part of the investment criteria of Independence and Expansion. This paper has confirmed its relevance.” – W. Higgons

William cross-references the ROCE criterion with the valuation criterion that James O’Shaughnessy found to be the best performer, the price/financing ratio. These theoretical foundations are applied to Indépendance AM funds, adding a series of tangible and measurable criteria.

For 30 years

Indépendance AM’s managers have been applying and refining the Quality Value strategy.

Their results year after year confirm the relevance of this approach.