1 Year of Independence Europe Mid

An anniversary under the banner of continuity in our Quality Value management!

Key milestones

In just 12 months, thanks to the trust of our investors, the fund has reached several important milestones:

>100 M€

in assets under management

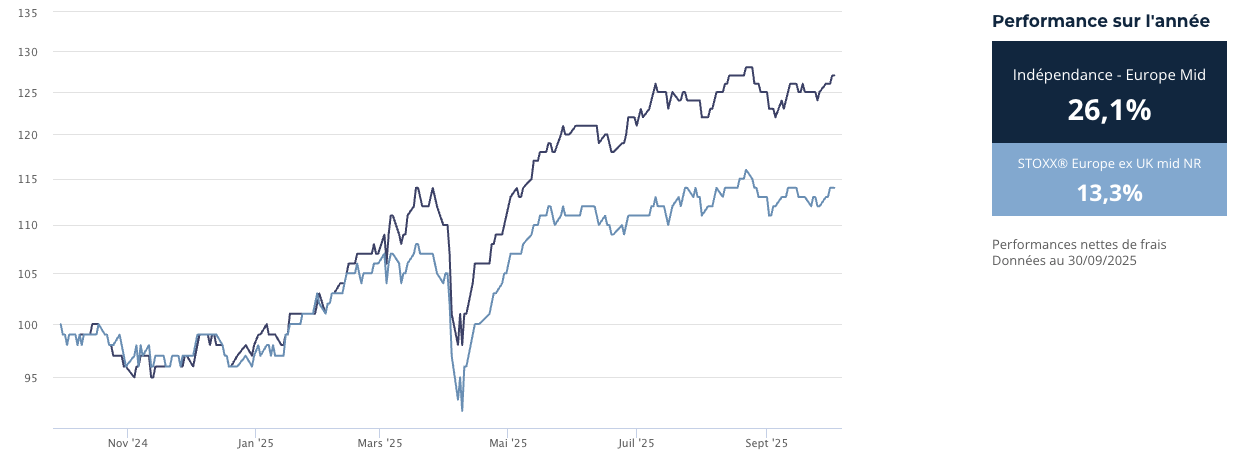

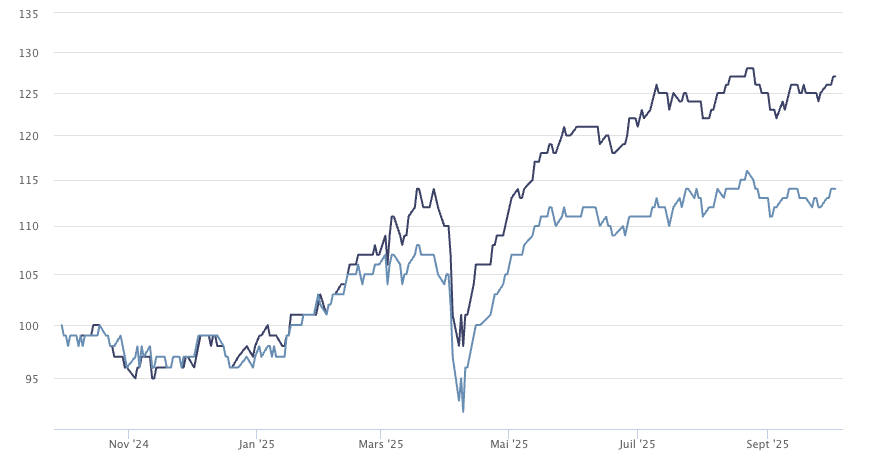

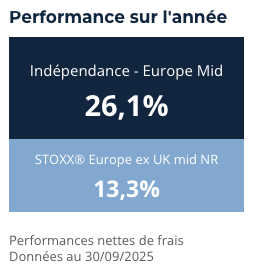

26,1%

performance 1

since launch

These results reflect the strength of an expertise built over more than 30 years, driven by a close-knit team exclusively dedicated to the analysis of European companies. Our approach remains true to our DNA: a rigorous, patient, and disciplined Quality Value management style.

1 Past performance is not indicative of future results and is not constant over time – performance of share class A over 1 year, from 30/09/2024 to 30/09/2025.

Key figures

Indépendance Europe Mid invests:

1

Across 15 European countries

2

With a median market capitalization of €2.8bn

and an average of €5.0bn

3

~ 75 % of holdings shared with other UCITS funds

A word from William Higgons, Director of Indépendance AM

We would like to warmly thank our investors and partners for their trust. Their support has been essential to the successful launch of this fund.

More than just a new fund, Europe Mid embodies the continuity of a clear DNA: a proven Quality Value strategy, unwavering discipline, and a strengthened team exploring the full potential of European mid caps.

Performance chart

A complementary pillar of our Quality Value strategy, driven by a strengthened team

With this first anniversary, Indépendance Europe Mid establishes itself as a complementary pillar of our Quality Value strategy, alongside Indépendance France Small & Mid and Indépendance Europe Small.

1

Identical Quality Value management: an investment strategy proven for over 30 years — conviction-driven, based on tangible criteria and patient, methodical company analysis.

2

An expanded scope: a fund able to invest in European companies with larger market capitalizations.

3

A strengthened investment team: Vincent Rouvière, an experienced portfolio manager, and analysts Mathilde Neau and Davide Longo — three new arrivals since 2024, enhancing our ability to cover European companies that meet our investment criteria in depth.

Interview with Victor Higgons,

CEO of Indépendance AM

One year after its launch, Indépendance Europe Mid confirms its role as a natural extension of our Quality Value DNA. At Indépendance AM, each fund launch is the result of continuity — the gradual expansion of our Quality Value strategy, proven for more than 30 years. Europe Mid is no exception.

Building on our experience with European Small & Mid Caps, this fund broadens our scope while remaining true to our historical approach: a conviction-driven Quality Value management style, founded on tangible criteria and a patient, methodical reading of businesses.

After launching Europe Small in 2018 — already exposed 25% to mid caps — it was only natural to take the next step. We wanted an investment vehicle with greater freedom in capitalization choices, similar to our flagship France Small & Mid fund, capable of combining smaller companies with well-established ones. That goal has now been achieved — at a continental scale.

Behind the Mid Cap category lies a remarkable diversity of companies, some capitalizing several billion euros and operating as true multinationals.

Less publicized than large groups, yet often more international than smaller companies, these businesses offer a rare balance of growth potential, financial clarity, and often attractive valuations.

Notre conviction ne repose pas sur une intuition, mais sur une méthode. Depuis plus de trente ans, nous appliquons nos principes d’investissements « Quality Value » : une stratégie rigoureuse, tangible, mesurable, qui consiste à acheter des sociétés à la fois très rentables et décotées.

Behind this launch stands a team. The arrival of experienced fund manager Vincent Rouvière, along with analysts Mathilde Neau and Davide Longo, has strengthened our capacity to cover European markets in depth. Our investment team now numbers nine professionals, 100% dedicated to identifying listed European companies that meet our criteria.

Investing means building a coherent bouquet, not merely collecting the most beautiful flowers. That is why we constantly monitor the valuation of our holdings: when a stock appreciates too much and no longer contributes to portfolio performance, it is trimmed to make room for new opportunities. This dynamic yet disciplined management is our hallmark.

We refuse to compromise between quality and valuation. And this unwavering discipline continues to pay off. After one year, Europe Mid has delivered a performance of over +26.1%² as of end-September 2025, significantly outperforming its benchmark index.

We do not make macroeconomic bets. We do not issue bold predictions. What we do is analyze — line by line — hundreds of annual reports, visit factories, meet management teams, and study business dynamics to combine analytical rigor with real-world understanding.

One year after its launch, Europe Mid stands as a new expression of a clear and consistent DNA — true to who we are: a team dedicated to the patient implementation of a proven strategy. Because in investing, discipline is a strategy.

2 Past performance is not indicative of future results and is not constant over time – performance of share class A over 1 year, from 30/09/2024 to 30/09/2025.

Legal notice

This document is provided for informational purposes only and does not constitute an investment recommendation or an offer to buy or sell fund units. Past performance is not indicative of future results. Investors are invited to read the prospectus and the KID available on our website before making any investment decision.